Welcome to 2024! As of January 1st, all existing businesses registered with a state as an LLC or partnership need to buckle up and register with FinCEN by filing a Beneficial Ownership Information report. FinCEN stands for the Financial Crimes Enforcement Network and is not part of the IRS. It might sound a bit intimidating, but fear not! Keep reading as we walk you a quick guide to filing a BOI report for your LLC. Do it before December 31st!

The FinCEN Beneficial Ownership Information Reporting Process:

So, what’s the deal? By the end of 2024, every existing LLC needs to file a beneficial ownership information report with FinCEN. All new LLCs in 2024 need to file this report within 90 days. LLCs will have 30 days to file their BOI report if they form in 2025 and beyond. This might seem like a daunting task, but we’ve got your back. A detailed PDF guide is available for download, providing step-by-step instructions on every click and action needed to complete the registration.

Beware of BOI Report Scams:

Before we dive into the details, a quick heads up: scammers will be reaching out, claiming you’ll be arrested if you don’t register immediately. Ignore the noise – this process is manageable, and you can file your BOI report yourself. Unfortunately, we can’t do it for you due to insurance provider constraints, but we’ll guide you through it. You won’t be arrested…as long as you register existing businesses by December 31, 2024 (or within 90 days if you start a new business in 2024; within 30 days for new businesses after January 1, 2025).

Creating a FinCEN ID:

Before starting the Beneficial Ownership Information report, create a FinCEN ID to protect your personal information. Why? In case of a breach, you don’t want your details floating around. Our PDF guide includes steps to obtain a FinCEN ID using your valid driver’s license or passport. It’s a simple process that adds an extra layer of security.

Filing the Beneficial Ownership Information Report:

Once armed with your FinCEN ID, it’s time to file the BOI report for your LLC. Head to FinCEN.gov/BOI, and the process begins. The guide covers every detail of this step, making it a breeze for you to navigate.

Why the Fuss?

This mandatory registration stems from the Corporate Transparency Act, passed in 2021. It’s the government’s effort to better understand the ownership of small businesses, and preventing misuse of the financial system. While it might seem like a hassle, it’s a crucial step to ensure transparency and keep our financial systems free from potential misuse.

Do I really need to file this report?

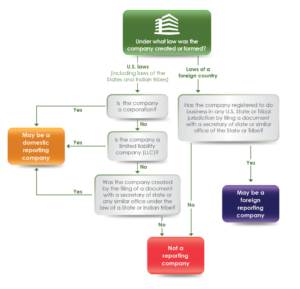

Maybe not. The key question in the flowchart I grabbed from FinCEN’s website asks, “Was the company created by the filing of a document with the secretary of state…?” Sole proprietors who have not formed an LLC or partnership do not likely need to file the BOI report. Think back to when you started your business. The IRS provides the EIN (Employer Identification Number). Did you register anything with your secretary of state? If not, don’t worry about this.

Here is FinCEN’s decision guide to determine if you need to file the BOI report:

Consequences of NOT Filing a BOI Report in time:

Consequences of NOT Filing a BOI Report in time:

Skipping this report filing can lead to significant consequences, including up to $10,000 fines and prison time. Yikes! We won’t delve into the scary details about the civil and criminal charges here. Just know – it’s in your best interest to get this done by the end of the year. FinCEN doesn’t mess around.

And there you have it – a quick guide to FinCEN registration for LLCs in 2024. We hope this information proves helpful. Should you have any questions, don’t hesitate to reach out. Thanks for reading, and happy registering!

Get our step-by-step guidePsst! Looking for help with your taxes?

If you are an owner-operator and aren’t sure if your tax professional knows much about the trucking industry, look closer at WestboundHQ. Trucking taxes are our expertise! Let’s talk — start (click) here.